Ask About Invoice Details 3278463408

When examining invoice number 3278463408, it is crucial to dissect the various charges involved. This includes shipping costs, taxes, and service fees. Understanding these components aids in grasping the full financial picture and supports effective communication with the service provider. In cases of discrepancies, having supporting documentation can be invaluable. However, the approach to resolving such issues may vary significantly, prompting further exploration into best practices for effective communication and dispute resolution.

Understanding Invoice Number 3278463408

What insights can be gleaned from Invoice Number 3278463408? A thorough invoice breakdown reveals the specific components contributing to the total.

Charge analysis identifies discrepancies and validates expenses, offering transparency. This examination empowers stakeholders to question charges, promoting a culture of accountability.

In the pursuit of financial freedom, understanding such details is essential for making informed decisions regarding expenditures.

Common Charges Explained

Analyzing common charges on an invoice provides clarity on the financial obligations associated with a transaction.

Common fees typically include shipping costs, taxes, and service charges. A detailed charge breakdown allows customers to understand each element contributing to the total amount due.

This transparency fosters trust and enables individuals to make informed financial decisions, ultimately enhancing their sense of freedom in managing expenses.

Payment Terms and Conditions

Understanding the payment terms and conditions is crucial for both buyers and sellers, as these stipulations dictate the timeline and method of payment.

Clearly defined payment deadlines ensure timely transactions, while awareness of potential late fees reinforces accountability.

How to Communicate With Service Providers

Effective communication with service providers is essential for ensuring that expectations are met and services delivered as promised.

Establishing clear lines of dialogue fosters strong service provider relationships, enabling both parties to articulate needs and concerns effectively.

Utilizing concise language, active listening, and timely follow-ups enhances collaboration, ultimately contributing to a more productive partnership and successful outcomes for all involved.

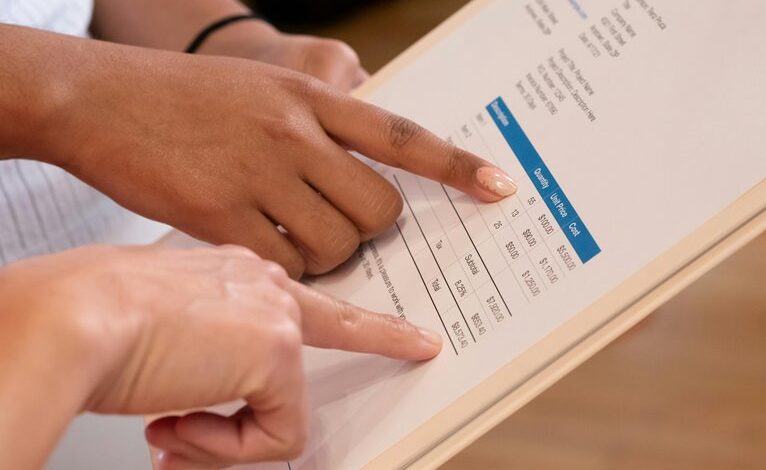

Tips for Disputing Invoice Errors

Disputing invoice errors requires a systematic approach to ensure that discrepancies are addressed promptly and effectively. Key tips include gathering relevant documentation, clearly stating the nature of the invoice discrepancies, and maintaining open communication with the service provider to facilitate dispute resolution.

| Step | Action | Outcome |

|---|---|---|

| Identify Errors | Review invoice details | Recognize discrepancies |

| Communicate | Contact provider | Initiate resolution |

| Follow Up | Document responses | Ensure accountability |

Conclusion

In the realm of financial transactions, invoice number 3278463408 serves as a map guiding one through the intricate forest of charges. Each component—shipping costs, taxes, and service fees—represents a distinct path that, if misread, can lead to confusion and miscommunication. By engaging in open dialogue and addressing discrepancies with clarity, one can navigate this landscape effectively, ensuring that trust and accountability flourish like sunlight filtering through the trees, illuminating the way toward a harmonious business relationship.